The rise of environmental, social, and governance (ESG) issues in the minds of consumers and investors has drawn recent criticism, with detractors suggesting the movement is toothless or simply greenwashing. What these critics fail to realize is that ESG expectations are more and more often being codified into law, and this new legislation is seeing a rise in enforcement.

One of these laws is the Uyghur Forced Labor Protection Act (UFLPA). Since its entry into force on June 21, 2022, UFLPA compliance has generated major headlines that serve as a reminder that forced labor is not just an undesirable social problem but a major business risk with the power to disrupt entire sectors and deny businesses the ability to sell into the lucrative US market.

The UFLPA is a U.S. law that establishes a rebuttable presumption that goods made wholly or in part in China’s Xinjiang Uyghur Autonomous Region (XUAR) are made with forced labor and excluded from entry into the U.S. Companies with products that involve supply chains in China must be careful to avoid the application of that presumption to their shipments or else they will face detentions. Even companies that do not import directly from China could have shipments detained if the materials used to produce the goods are linked to the XUAR or to entities or materials associated with forced labor in China.

Paying the Price for UFLPA Non-Compliance

In its first enforcement report following the UFLPA’s entry into force, U.S. Customs and Border Protection (CBP) revealed that in the month of August 2022, it targeted 838 entries valued at more than $266.5 million USD for suspected use of forced labor in the production of imported goods, including goods subject to the UFLPA and withhold release orders. To put that into perspective, CBP’s enforcement figures for the entire 2021 financial year amounted to $485 million USD. That means that in just one month, the CBP surpassed half of its enforcement figures for the previous 12-month period of the financial year.

The intensity of enforcement is even more striking when comparisons are made with other critical regulatory compliance issues such as anti-bribery and anti-corruption, as set out in the Foreign Corrupt Practices Act (FCPA). Data shows that between 2016 and 2022, there were 82 fines issued against companies for FCPA violations. In contrast, the UFLPA, which only came into force at the end of June 2022, has already seen more than 1,500 shipments denied entry into the U.S. as of September 2022.

There are no indications that enforcement intensity will slow — if anything, recent statements from the CBP and enhanced scrutiny of shipments into the U.S suggest enforcement will ramp up. Such steps include the recent addition of forced labor screening functionality into the Automated Commercial Environment (ACE), the system through which the trade community reports imports and exports and the government determines admissibility. This means once implemented, every shipment entering the US will now be screened by the most sophisticated database on the planet for risk of forced labor and ties to Xinjiang.

This level of scrutiny should definitely ring alarm bells for companies that have no visibility into their supply chains. Knowing your suppliers and where your goods come from is essential to avoiding goods detention and maintaining U.S. market access.

As far-reaching as CBP scrutiny is, it’s not the only kind of scrutiny companies have to deal with when it comes to the UFLPA. There is emerging evidence that listed companies must be prepared for UFLPA scrutiny from an unexpected source: the Securities and Exchange Commission (SEC). In recognition of the fact that the UFLPA has the potential to create business disruptions, the SEC is now seeking disclosures around whether listed companies import from Xinjiang and if so, what material impacts, if any, the UFLPA could have on a company’s ability to obtain supplies and fulfill customer orders. Listed companies must therefore be prepared for the possibility that their actions or inactions around the UFLPA could be reflected in SEC filings, which is public information and opens them up to further public and investor scrutiny.

To learn more about supply chain ESG and how you can build deep sustainability, read our guide, How to Uncover Hidden ESG Risks in Your Supply Chain.

UFLPA Enforcement: Implications for Businesses

The current level of enforcement around forced labor is unprecedented. It not only demonstrates that the eradication of forced labor in supply chains is a priority issue for the U.S. government — it’s also a wake-up call for companies: forced labor is an urgent, business-critical issue that must be addressed now.

Commenting on the implications of UFLPA enforcement for businesses, Robert Silvers, Undersecretary at the U.S. Department of Homeland Security stated as much in a September 2022 interview with the Wall Street Journal:

It is instructive that Mr. Silvers, who chairs the interagency Forced Labor Enforcement Task Force (FLETF) — the body tasked with enforcing the UFLPA — framed his comments not just around the UFLPA, but forced labor as a whole. The reason is obvious; forced labor due diligence is an increasingly material topic for businesses for reasons beyond the UFLPA.

The Broader ESG Landscape

Forced labor is a key component of the ESG framework that businesses in the global economy are increasingly expected to align with. Reports indicate that up to 85% of investors consider ESG factors as part of their financial analysis. Forced labor due diligence is an integral aspect of that framework, and there is evidence of investors taking action to distance themselves from businesses found to be linked to forced labor. Other investors such as BNY Mellon, Lazard, and Abrdn have made addressing forced labor a priority issue with some like AllianceBernstein developing their own models to identify portfolio companies’ risk of forced labor.

Inaction Is No Longer an Option

New rules and regulations around forced labor are also popping up in several jurisdictions around the world. For example, the EU recently adopted a proposal for a new regulation that would specifically ban products made with forced labor from the EU market. The proposal is much broader than the UFLPA, covering all products and all jurisdictions, rather than a specific region or set of goods and materials. This regulation would join others like the German Supply Chain Due Diligence Act (SCDDA), the UK Modern Slavery Act, Australian Modern Slavery Act, and Canada’s imminent Modern Slavery Act.

New Forced Labor Considerations for the Trade Community

Beyond the UFLPA, trade rules and initiatives are increasingly making forced labor compliance a core issue for the trade community. For example, the United States Trade Representative (USTR) is developing a focused trade strategy to combat forced labor that will, among other things, focus on the development and utilization of new and innovative trade tools by the U.S. government to combat forced labor in traded goods and services.

Another very important initiative of the trade community, the Customs Trade Partnership Against Terrorism (CTPAT), introduced new minimum security requirements related to forced labor in August 2022. Participants will now have to develop social compliance programs that ensure forced labor is not used in the production of goods imported into the U.S. Existing CTPAT members have until August 2023 to provide the CBP with evidence of the implementation of those plans, while aspiring members must already have those plans in place prior to applying. Failure to prioritize forced labor would mean companies lose access to CTPAT membership, including its benefits and privileges such as reduced CBP examination, shorter wait times for goods coming into the US, front-of-the-line inspections, and priority business resumption priority in the event of a disaster.

Financial & Non-Financial Impacts

Lack of forced labor due diligence, particularly concerning the UFLPA, comes with a long list of obvious and hidden costs for companies. For one, the detention of goods translates into loss of market access. Detained goods cannot be sold in the U.S. and must be either exported or destroyed at the cost of the importing company.

Companies can fight the detention, but they must pay for:

- Storing goods while they fight the detention

- Legal costs to fight the detention

- Employee time spent gathering information from suppliers to prove goods were not made by forced labor

They also risk canceled orders, the inability to fulfill contracts due to lack of supplies, and lost trust in the company. There are also indirect costs to consider, including brand damage, the need to redesign products, change components, or find alternative suppliers that are not linked to forced labor.

A New Era in Forced Labor Law

Compliance professionals and business leaders have historically not given forced labor issues in their supply chains the same level of attention as compliance issues like anti-corruption. However, rising enforcement demonstrates the urgent need to recognize and act on the fact that forced labor could create massive business disruptions. Business leaders and compliance professionals must recognize the enormous risk that forced labor issues in the supply chain poses to profitability and business continuity. Compliance strategies must broaden to accommodate this reality.

Streamline UFLPA Compliance With Assent

To comply with the UFLPA and growing demands for more sustainable supply chains, you need deep visibility into your supply chain.

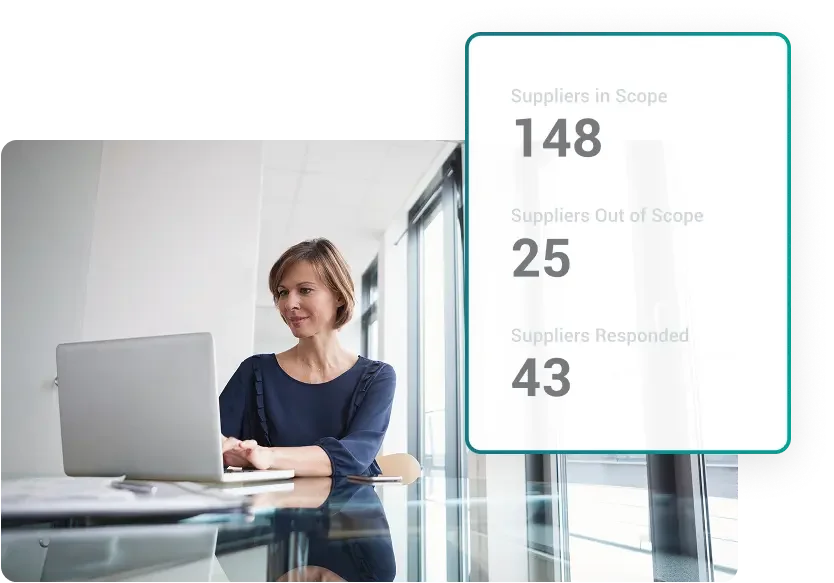

Assent deep maps manufacturing supply chains, allowing you to monitor suppliers, parts, products, and regulations to meet global requirements.

By identifying high-risk and low-risk suppliers, you can prioritize third parties for screening and education, and engage them as equal partners in your journey to deep sustainability

To learn more about how Assent can help you Contact us