Companies that compete for U.S. federal government contracts are required to comply with the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS). Contractors and subcontractors working with the Department of Defense (DOD) are in scope of DFARS, while FAR also applies to contracts issued by other departments.

Any company in scope of DFARS is also in scope of FAR. You can view FAR compliance requirements here.

What Is DFARS?

The defense supplement was established to address the inherent differences in meeting national defense requirements. It has a wide scope and creates numerous requirements for prospective contractors, including approved ways to store and communicate data, where to source material, and other mandatory stipulations. The regulation frequently changes, both through direct amendments to the supplement and by changes made to the original FAR. To be DFARS compliant, companies must be able to demonstrate they meet all of the applicable contractual flowdowns.

Companies In Scope of DFARS

Any company engaged in fulfilling the terms of a DOD contract may be in scope of DFARS clauses. In practice, this means that direct contractors, as well as their subcontractors and suppliers, must meet the requirements under the regulation. In 2018, the DOD spent over $364 billion USD on contracts, meaning thousands of companies are or have been subject to DFARS requirements.

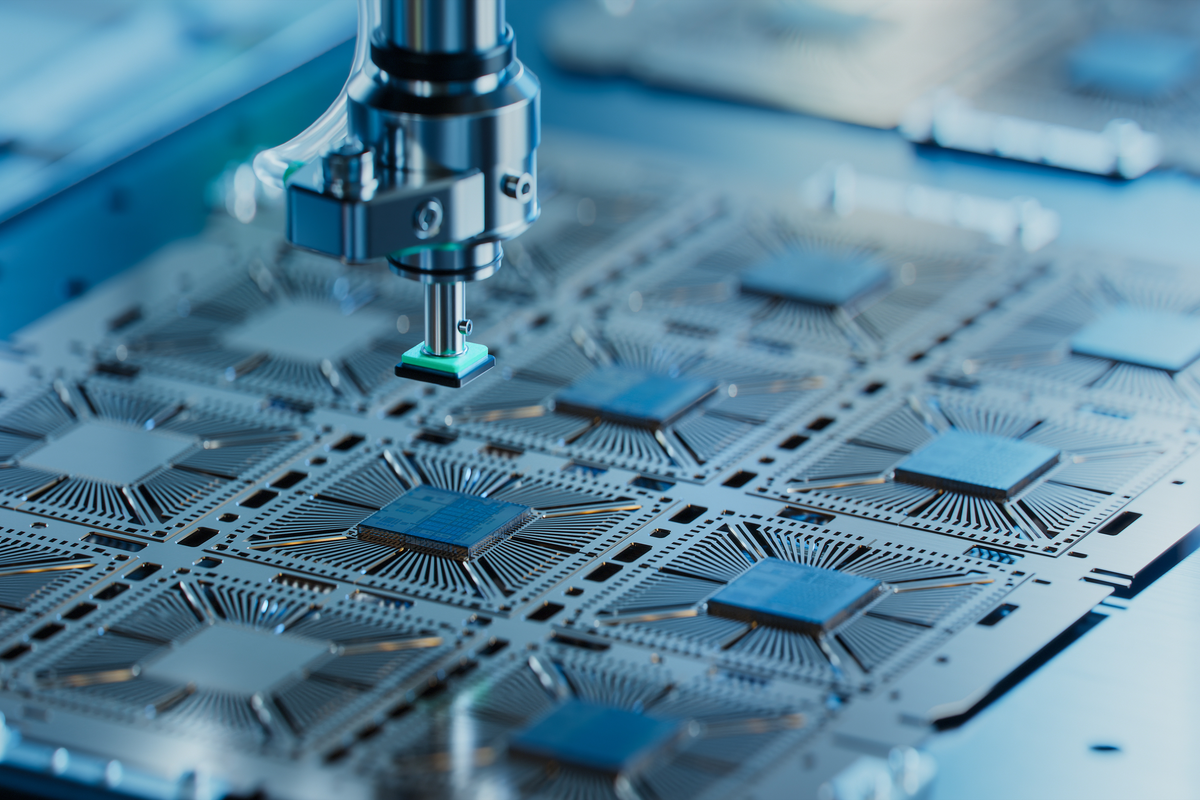

Speciality Metals: DFARS 252.225-7009

A key DFARS stipulation limits the source of origin for certain materials in order to protect the country’s processing capability and its supply chain from reliance on critical foreign materials. There are two key considerations when complying with this clause: What is the material? And where did it come from?

DFARS Compliant Source Countries

By and large, companies may only use specialty metals sourced from the U.S. or NATO countries, with some exceptions.

The following countries are approved by the Speciality Metals flowdown:

- Australia

- Austria

- Belgium

- Canada

- Czech Republic

- Denmark

- Egypt

- Estonia

- Federal Republic of Germany

- Finland

- France

- Greece

- Israel

- Italy

- Japan

- Latvia

- Luxembourg

- Netherlands

- Norway

- Poland

- Portugal

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- United Kingdom of Great Britain and Northern Ireland

DFARS Compliant Material

Not all metals are considered specialty metals. The supplement defines the specialty metals in scope as:

- Steel.

-

- With a maximum alloy content exceeding one or more of the following limits: manganese, 1.65 percent; silicon, 0.60 percent; or copper, 0.60 percent.

OR

- Containing more than 0.25 percent of any of the following elements: aluminum, chromium, cobalt, columbium, molybdenum, nickel, titanium, tungsten, or vanadium.

-

- Metal alloys consisting of nickel, iron-nickel.

- Cobalt base alloys containing a total of other alloying metals (except iron) in excess of 10 percent.

- Titanium and titanium alloys.

- Zirconium and zirconium base alloys.

In December 2019, the DOD prohibited the acquisition of certain magnets and tungsten from North Korea, China, Russia, and Iran through an amendment to DFARS.

To maintain compliance, companies must only use the above material when sourced from any of the above countries, unless specifically exempted.

Specialty Metals Exceptions

There are exceptions to the DFARS Speciality Metals rule, including:

- As required in the interest of national security.

- When specialty metals are not available in sufficient quantities, in the necessary form, or cannot be acquired when they are needed.

- When the acquisition supports U.S. combat or contingency operations.

- When necessary to complete an agreement with a foreign government.

- When used in small purchases.

- When used in off-the-shelf commercial items.

- When used in some electrical components.

Otherwise, non-compliant metal is permitted if it makes up no more than two percent of the final product.

How to Ensure Speciality Metals DFARS Compliance

The wide-impact of DFARS will be felt in nearly every operational capacity of a company competing for a U.S. government contract. As such, there are numerous best practices and guidelines companies should follow to ensure compliance. At a high level, it suffices to say that companies with transparent supply chains are better prepared for the stringent requirements than those that struggle to identify part or product composition and source of origin.

Assent provides companies with a transparent view of their supply chain, through the industry-leading Assent Compliance Platform. Automating supplier engagement and data validation, companies can efficiently scope even the largest supply chains for areas of concern and collect certificates of origin to help meet DFARS requirements. To learn more, contact us today.