Still Exploring?

Looks like you’ve been exploring our platform.

Want to see everything in one place?

Rising Regulatory Pressure

Data-Heavy Requirements

High Financial Stakes

Limited Resources

of company profits could be lost by 2030 if businesses fail to adapt to CBAM.

‘ McKinsey. (2024, June 28). New opportunities: Capturing value from CBAM regulation. https://www.mckinsey.com/ capabilities/operations/our-insights/operations-blog/new-opportunities-capturing-value-from-cbam-regulation

Download The CBAM Handbook for a walkthrough of your carbon reporting next steps.

Get Your CopyMay 17, 2023

CBAM enters into force

August 17, 2023

Implementing regulation for the transitional phase adopted

October 1, 2023 to December 31, 2025

Transitional phase begins

October 1, 2023

First transitional-phase reporting period starts

Importers must report within one month after each quarter-end:

January 31, 2024

First CBAM quarterly reports due

July 31, 2024

Importers can no longer rely on default emissions values; reports for complex goods must contain ≥ 80% primary data from installations

July 31 to December 31, 2024

Embedded emissions may be calculated using either the new EU method or, temporarily, an equivalent method

January 1, 2025

Only the EU method will be accepted in CBAM reports

February 26, 2025

Omnibus Simplification Package proposal published, aiming to reduce administrative burden for importers

Early 2025

CBAM Registry upgrades

May 2025

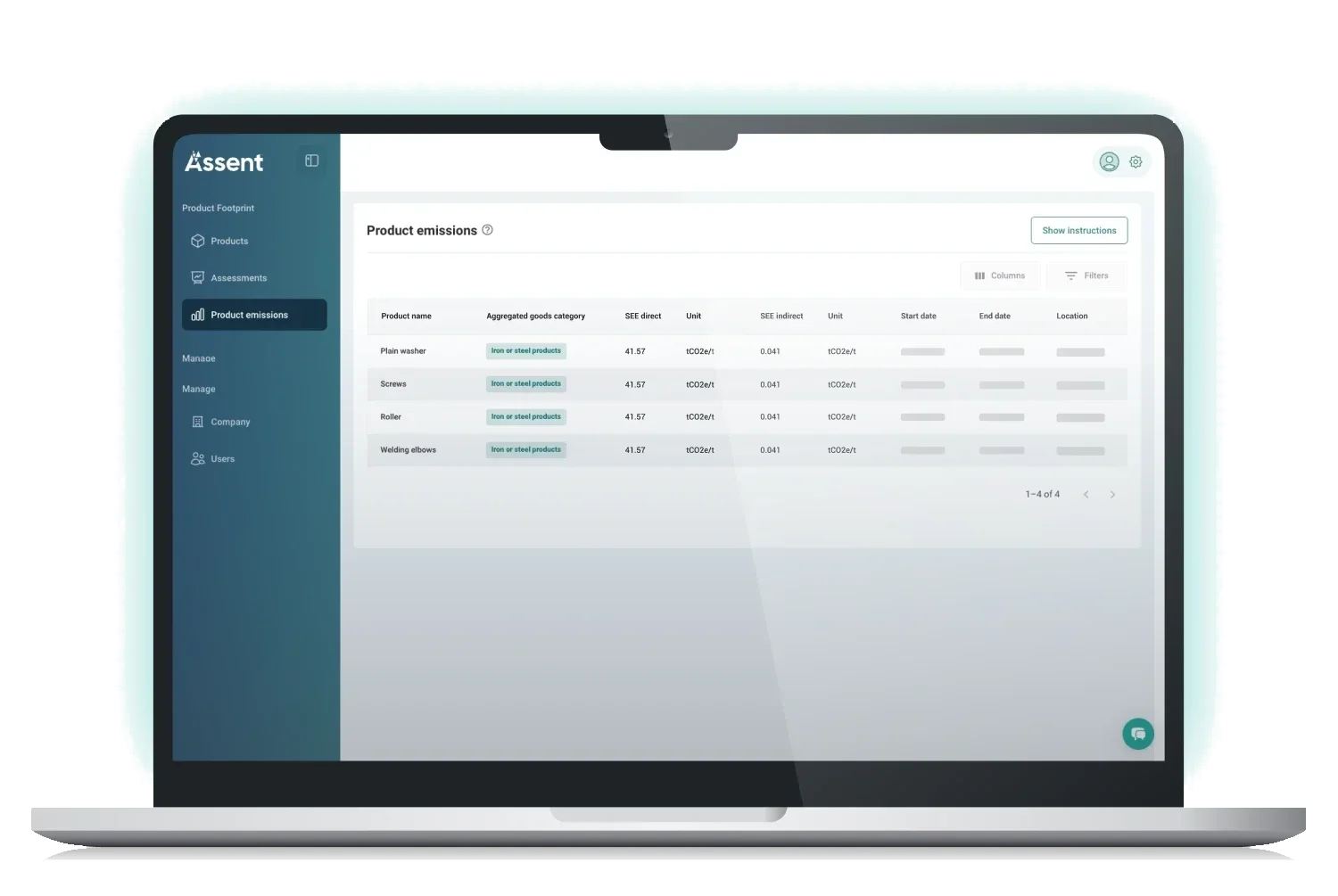

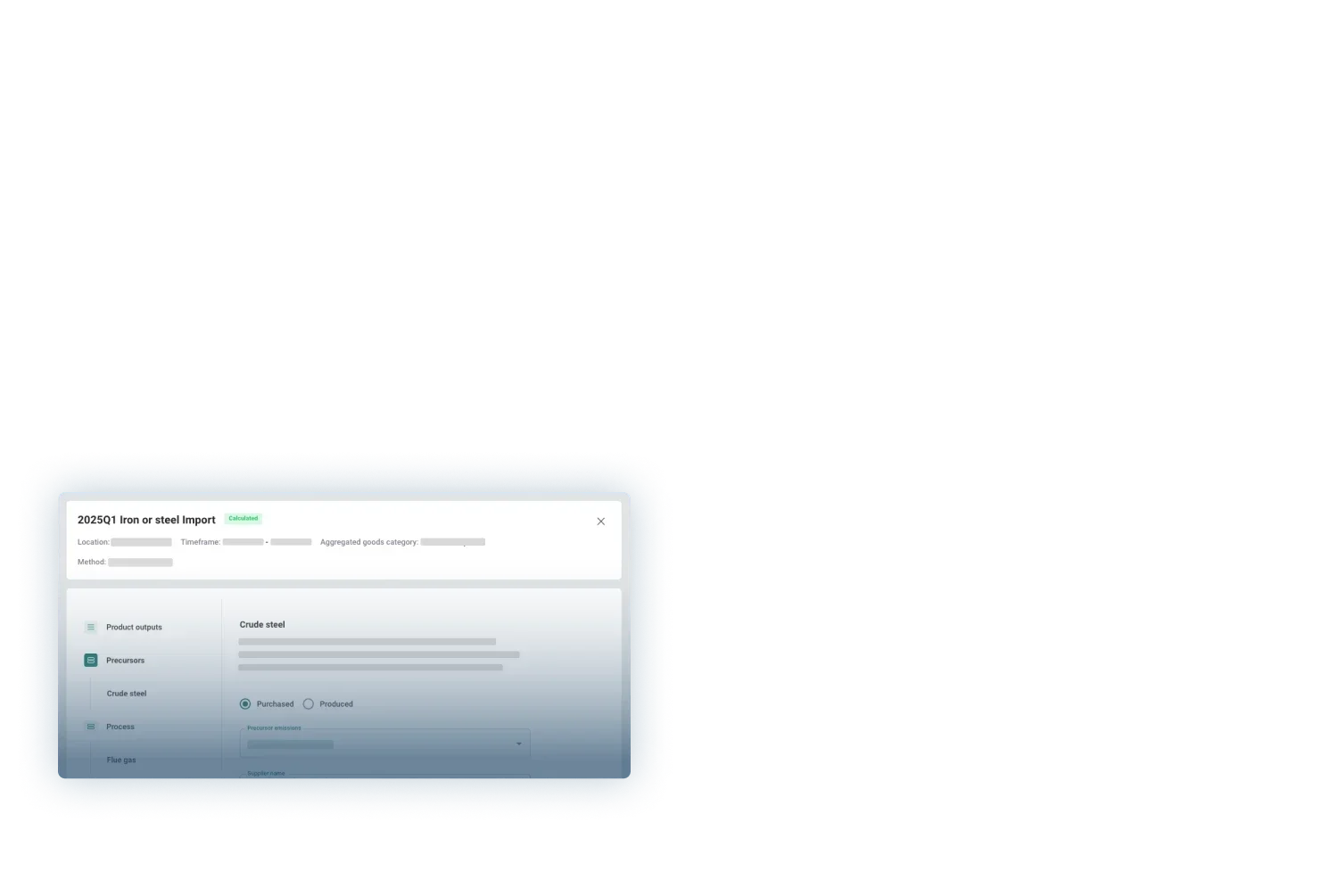

Assent launches a solution for CBAM compliance, with AI-tools and built-in carbon emissions calculator

January 1, 2026

Only registered Authorized CBAM Declarants may import CBAM goods

Need a hand with CBAM certificates?

Talk to an ExpertSeptember 30, 2027

Deadline to submit an independently verified CBAM declaration (covering CY 2026) to the Registry, including:

2030 (Outlook)

CBAM scope expected to expand to all goods covered under the EU Emissions Trading System (ETS)

Get ahead of

tomorrow’s

requirements

Actual emissions data has direct monetary value. Importers need embedded emissions reporting to cut certificate costs and avoid fines; suppliers need it to stay on customer short-lists. As CBAM tightens, the cost of inaction rises — from parts obsolescence to lost market access.

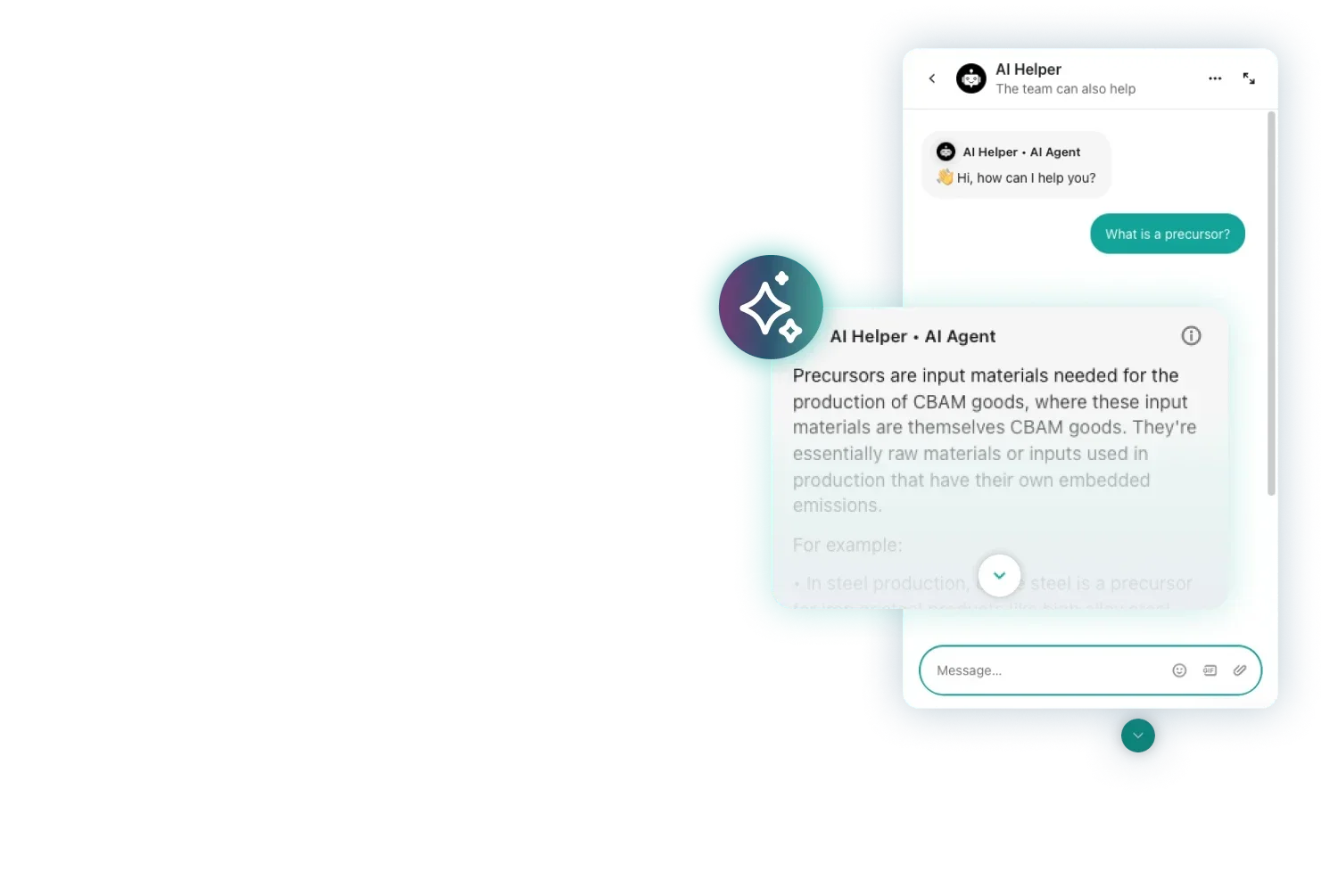

Assent removes the guesswork. Our AI-enabled platform couples expert guidance with automated, user-friendly workflows to gather primary emissions data, calculate carbon footprints, and create CBAM-ready reports — all in one place.

Hands-on expertise to decode CBAM rules

Direct supplier access through Assent’s network

Al-powered insights to simplify complex emissions data

Centralized emissions hub for direct and indirect data

Carbon survey built for quick supplier opt-in/out

CBAM-formatted outputs ready for registry upload

Audit-ready documentation for defensible reporting