If you import goods into the EU, the Carbon Border Adjustment Mechanism (CBAM) is likely already on your radar. Designed to level the playing field between EU producers and international suppliers, CBAM places a carbon price on certain imported goods based on their embedded emissions. Understanding the financial impact for importers can be complex.

This blog provides a clear overview of CBAM’s financial implications, including its mechanics, CBAM certificate pricing, key timelines, and practical strategies to support CBAM compliance and effective cost management.

1. CBAM Scheme: Brief Overview

CBAM is meant to prevent carbon leakage by ensuring that the price of imports accurately reflects their carbon content. This mechanism aims to equalize the carbon price paid by EU domestic producers, who are subject to the EU Emissions Trading System (ETS), and the carbon price of imported goods.

Materials in Scope

The CBAM regulation currently covers imports of the following carbon-intensive goods:

- Iron and steel

- Aluminum

- Cement

- Fertilizers

- Electricity

- Hydrogen

Timeline for the Permanent System

CBAM entered its transitional phase on October 1, 2023, primarily focusing on reporting obligations. The permanent system will come into full effect on January 1, 2026. This marks the beginning of the reporting period for importers.

Purchasing CBAM Certificates

EU importers will be required to purchase CBAM certificates to account for the embedded emissions of goods. These certificates represent the carbon price that would have been paid if the goods had been produced under the EU ETS.

- How Certificates Are Purchased: Importers will purchase CBAM certificates from a common central platform established by the EU. The number of certificates required will correspond to the reported embedded emissions of their imported goods, adjusted for any carbon price already paid in the country of origin.

- When Certificates Need to be Purchased: CBAM declarants must be registered by March 31, 2026, to continue to import CBAM goods. CBAM certificates will need to be purchased yearly, and emissions trading begins February 1, 2027. CBAM certificates will be priced retroactively for the average ETS price per quarter in 2026. Annual CBAM declarations and certificate surrender must be submitted by September 30, 2027, covering emissions from goods imported in 2026.

- This annual declaration and surrender of certificates will continue for subsequent years.

- Certificate Coverage: From 2027, importers must hold certificates covering at least 50% of year-to-date emissions on a quarterly basis.

- Surplus certificates can be resold to the authority, but only above the 50% coverage threshold, unless annual imports are below the de minimis of 50 tons.

- Repurchase applications for surplus certificates must be submitted by October 31 of the following year. If they are not resold by then, certificates will be cancelled.

CBAM Penalties for Non-Compliance

- Transitional Phase: Potential fines between €10–50 per tonne of unreported embedded CO2 emissions. No known penalties have been imposed yet.

- Permanent System: Potential fines up to €100 per tonne, with 3–5x multipliers for unauthorized imports of CBAM goods. This is in addition to having to purchase and surrender the required number of CBAM certificates (per tonne of CO2e) for their imports. The price of a CBAM certificate will be linked to the weekly average carbon price in the EU ETS.

- Additionally, non-registrants may face potential loss of market access, as the EU Commission and the National Competent Authority of each member state will be cross-checking authorized status of imports with the CBAM Registry. They reserve the right to not clear non-compliant goods for free circulation.

2. CBAM Certificate Pricing & Purchasing System

The financial burden of CBAM on importers will largely depend on the price of these certificates, which are directly linked to the EU ETS.

Overview of the CBAM Certificate Purchasing System

Importers will utilize a dedicated CBAM registry to manage their certificate accounts.

- Account Management: Importers will need to establish an account in the CBAM registry, where they will purchase, hold, and surrender certificates.

- Annual Surrender: By September 30 every year, importers must surrender a number of CBAM certificates corresponding to the total embedded emissions declared for goods imported in the previous calendar year.

- Benchmark Values and Free Allowances: The system incorporates benchmark values and a phase-out of free allowances for EU producers to ensure a fair transition. This means importers initially do not pay for 100% of their embedded emissions, as a portion is deducted based on a benchmark and phase-in factor, aligning with the gradual phasing out of free allowances for EU producers. This mechanism ensures that importers and EU producers are treated equitably during this transitional period.

Determination of CBAM Certificate Prices

The price of CBAM certificates will directly reflect the average weekly closing price of EU ETS allowances on the auction platform.

Formula to calculate number of CBAM certificates to purchase:

Total tons of CO2e embedded emissions in imported goods = Quantity of CBAM certificates

(1,000 tons of CO2e = 1,000 CBAM certificates)

Formula for certificate pricing:

The price of CBAM certificates will be determined by the below formula, which is designed to tie to the average EU ETS auction price and will increase year by year with the phase-in factor as the EU ETS free allowances are phased out. (By 2034, the phase-in will be complete and 100% of embedded emissions will need to be paid for by the importer.)

CBAM Certificate Cost (EUR) = (CBAM Emissions – (CBAM Benchmarks x (1 – Phase-in Factor) ) ) x EU ETS Price

- CBAM Emissions: tCO2/ton of product (EU default values, actual emissions, or a mix)

- CBAM Benchmarks: tCO2/ton of product (based on 10% best performing EU ETS installations)

- Phase-in Factor: Percentage of total emissions importer is responsible for, increasing each year from 2.5% in 2026 up to 100% in 2034.

- EU ETS Price: € (weekly average price of carbon on the EU ETS)

Total CBAM Import Cost (Quarterly) = Number of CBAM Certificates x CBAM Certificate Cost at Time of Purchase

- Default Values: Default values will be issued by the European Commission and updated values for the permanent system are expected in December 2025.

- When reliable data from exporting countries is available, the default values will be set at the average emissions intensity for each good increased by a proportionally designed markup.

- When reliable data from an exporting country is not available, the average emissions intensity for the top 10 exporting countries with reliable data will be used.

- Default values include a markup resulting in a higher carbon price, with the goal of incentivizing collection of actual emissions data over using default values.

- Pricing Estimates: Various sources provide estimates for future EU ETS allowance (EUA) prices, which directly translate to CBAM certificate prices:

- A Reuters survey in late 2024 forecasted an average EUA price in 2026 at approximately €92.48 per tonne of CO₂.

- Other analyses suggest prices in the range of €90–100 / tCO₂, subject to emissions caps, supply dynamics, and Market Stability Reserve (MSR) mechanisms.

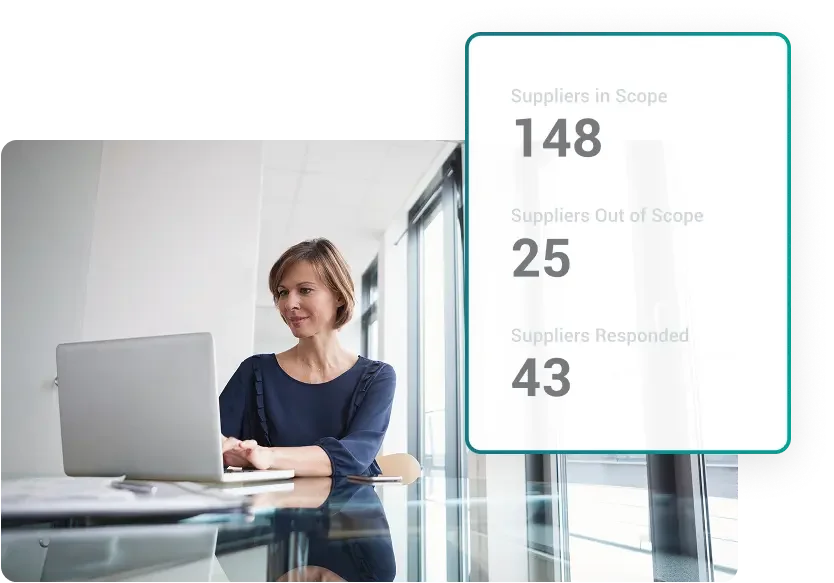

3. How to Use CBAM Software

Assent’s CBAM software enables customers to collect actual emissions data from suppliers to reduce the financial impact of CBAM imports. Default emissions values will have a markup, resulting in higher reported emissions and higher costs. Collecting actual emissions data from manufacturing installations avoids inflated emissions totals and will result in lower carbon costs.

CBAM Regulatory Expertise & Supplier Support

- Regulatory Expertise: Assent’s team of regulatory experts monitor the latest updates with CBAM legislation and implementation. This team is available as a resource to provide support and education, and address any questions around CBAM compliance.

- Supplier Focused Support: Assent’s Supplier Support team operates across time zones and provides support in multiple languages. They can answer any and all questions suppliers may have. Suppliers have access to Assent’s Supplier Help Center to get guidance and education on providing accurate data.

Assent CBAM software helps importers navigate CBAM requirements with confidence, from emissions data collection to calculating embedded emissions. Book a demo to see how Assent can support your CBAM strategy.

FAQ: CBAM Certificates & Financial Impact

Get answers to the most common questions about the financial impact of the EU Carbon Border Adjustment Mechanism (CBAM).