The U.S. Bureau of Industry and Security (BIS) has introduced a major shift in how export controls operate. The new BIS 50% Rule, often referred to as the Affiliates Rule, expands restrictions far beyond the companies that appear by name on the Entity List or the Military End User List.

The BIS 50% Rule applies Entity List and MEU List requirements to any entity owned 50% or more by one or more listed parties. This includes direct ownership and indirect ownership that runs through holding companies, layers of subsidiaries, and multi-step corporate structures. The affiliates inherit the same licensing requirements, license exceptions, and review policies that apply to the listed owner.

That means your organization cannot export to a listed entity, or to another company owned at least 50% by listed entities. To meet trade compliance requirements, you need to complete far more robust due diligence into your international trade partners.

The rule closes a long-recognized gap where listed companies conducted business through subsidiaries that were not formally identified. BIS has made clear that ownership is now a central factor in determining whether an entity is restricted.

The Impact of the BIS 50% Rule on Your Organization

This transformation in policy reflects a broader move toward ownership-based controls as a central tool of national security and foreign policy. Manufacturers that rely on complex global supply chains now face a higher expectation for visibility into who they do business with and how ownership connects across countries, industries, and corporate structures.

The rule becomes fully enforceable in November 2026, so preparing now is crucial. That’s because beneficial ownership relationships between listed entities and subsidiaries are not often transparent or immediately detectable. Corporate ownership structures are often designed that way on purpose.

Because the rule focuses on ownership flowing downward, a subsidiary that meets the threshold is captured even if it operates under a different name or in a different jurisdiction. A parent company above a listed subsidiary is not automatically covered, which means analysis must be precise and targeted.

For example, global companies may operate through legal entities that use different languages, scripts, and naming conventions. Some change names over time or maintain multiple “also known as” aliases that complicate identification when you’re only referencing static entity lists. Relying on a simple check of the Consolidated Screening List is no longer sufficient. You must uncover relationships that are not visible in name-based screening.

Compliance with the BIS 50% Rule is even more complex because the scope expands rapidly when one designation creates many affiliates. A single listed party can connect through its holdings to dozens or sometimes hundreds of additional entities. When this is multiplied across thousands of listed entities worldwide, the scale of the compliance challenge becomes far larger than it appears from the published lists alone.

How to Comply With the BIS 50% Rule

Compliance with the BIS 50% Rule requires deeper visibility than most teams have needed in the past. Several capabilities are now essential:

- Beneficial ownership insight across multiple jurisdictions. Ownership data does not appear in a single centralized source. It must be pieced together from corporate registries, disclosures, financial reports, litigation records, and reliable news sources.

- Awareness of aggregated ownership. A company owned 30% by one listed party and 20% by another can fall under the rule even though neither owner holds majority control individually. This level of aggregation cannot be identified without structured data that reveals the relationships.

- Real-time monitoring of regulatory changes. New entities are added to the Entity List and MEU List frequently. Ownership structures evolve as companies reorganize, acquire assets, or shift holdings. Screening must occur continuously.

- A clear documentation trail. BIS has emphasized the importance of demonstrating due diligence. This includes documenting ownership research, follow-up questions, screening logic, and licensing decisions. You will need strong, documented evidence to maintain trade compliance.

Failure to meet BIS requirements can result in loss of export privileges, fines, and stopped shipments at the border.

Simplify Your BIS 50% Rule Compliance

The additional compliance burden created by the BIS 50% Rule cannot be managed through manual research or traditional screening tools.

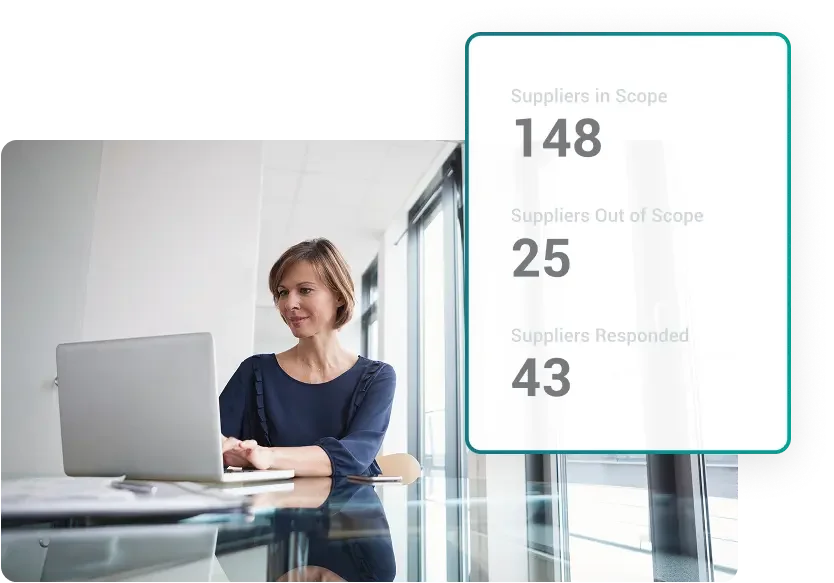

Assent’s Enhanced Entity Screening solution was designed to simplify this regulatory complexity. Our team of experts, combined with our native-AI data solutions, applies OFAC’s 50% ownership logic to identify beneficial ownership relationships that standard screening cannot uncover. This includes identifying multi-step ownership paths, offshore affiliates, and name variations, across multiple jurisdictions.

We give you defensible evidence to be confident in your compliance and make informed trade compliance decisions, all in a fraction of the time and budget it would take to accomplish internally.

The new BIS rule marks a shift toward ownership-focused export controls. Manufacturers that invest in insight, automation, and continuous monitoring well ahead of the November 2026 enforcement date will be the ones best positioned to adapt to the coming changes. Don’t wait until your bottom line is affected to start uncovering sanctioned entities.

FAQ: BIS 50% Rule (Affiliates Rule)

Get answers to the most common BIS 50% Rule questions from our team of regulatory experts.