Automobiles are among the most complex products on the market and have a correspondingly complex supply chain. Each of the thousands of parts that comprise an automobile represent a regulatory risk for original equipment manufacturers (OEMs) and suppliers. To effectively respond to these risks, companies in this industry must address their operational complexity by first understanding the impact of multiple supply chain layers on regulatory risk.

The Global Regulatory Landscape

Automotive industry manufacturers market their products around the world, and as a result, face numerous and varied global regulations such as the European Union (EU) Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation, EU End-of-Life Vehicles (ELV) Directive and the U.S. Toxic Substances Control Act (TSCA). These regulations establish limitations, restrictions or obligations on the use of certain substances in automobile manufacturing.

The multitude of parts in an automobile necessitates extensive data collection to demonstrate compliance with all legislative requirements. As seen last year, a single non-compliant part represents a very real risk of enforcement action, including fines and market recalls. For added complexity, the regulatory landscape is continuously expanding and evolving, requiring companies to keep up to date with changes and understand their impact. Automobiles may be exempt from regulations in one jurisdiction, but not in another, requiring an agile compliance program.

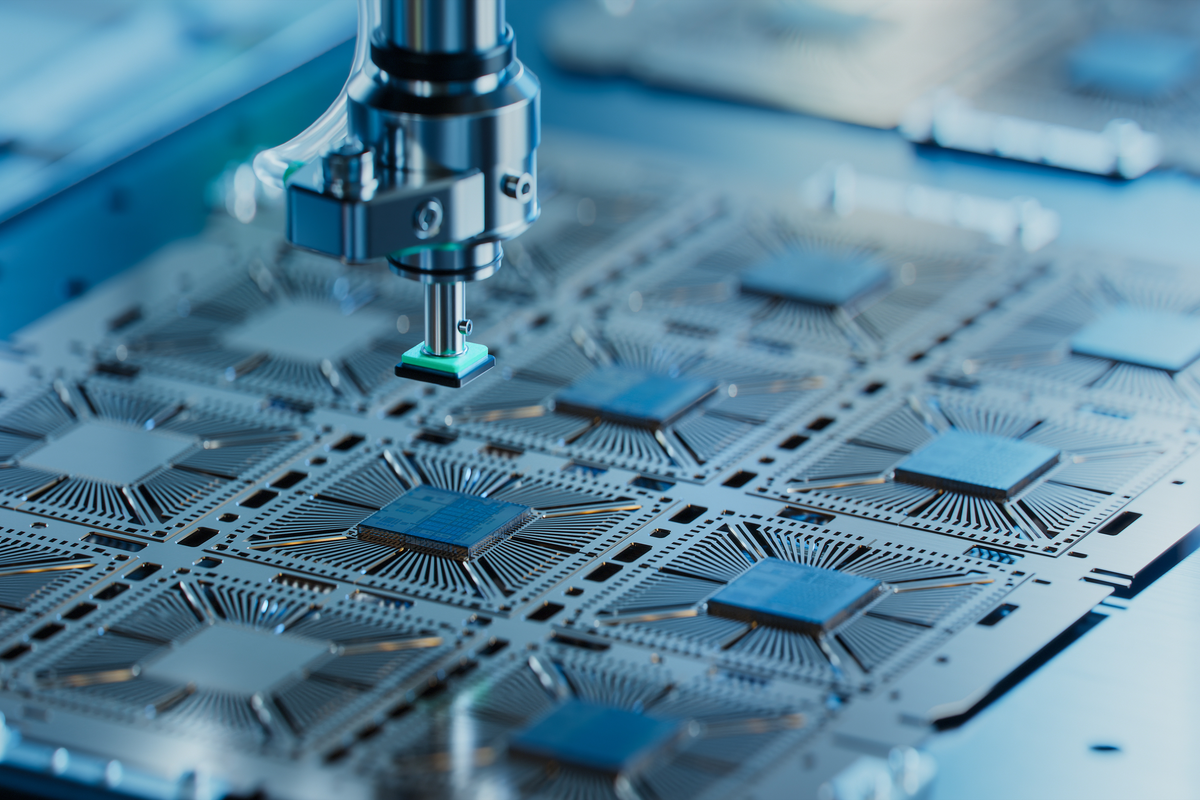

For the automotive industry, the complexity issue has grown as cars have dramatically changed in recent years. The use of electronic components is extensive, drastically increasing supply chain complexity. The current transition to electronic vehicles and the wave of self-driving technology is accelerating this trend. Many suppliers of these components did not previously work with automotives, and have been focused on parallel regulatory platforms like the Restriction of Hazardous Substances (RoHS) Directive and Waste Electrical and Electronic Equipment (WEEE) Directive, rather than industry-specific legislation such as the ELV Directive.

To learn more about the complicated regulatory landscape surrounding the automotive industry, download our eBook, Navigating the Compliance Landscape: Automotive.

Supplier Webs & Standardization

Regulations go beyond finished products and every automotive manufacturer supplier faces their own obligations. Tier One or Two OEM suppliers generally manufacture complex products in their own right, including engines, dashboard display systems and car batteries. Original equipment manufacturers and upstream suppliers must collect all necessary data to demonstrate compliance and communicate this data to regulatory authorities and their customers.

The Global Automotive Declarable Substance List (GADSL) was created to help manufacturers and suppliers better identify substances and thresholds and streamline the process of meeting regulatory requirements. Any collected data concerning substances that pose a risk to automotive companies must be checked against this extensive list.

To obtain Reusability, Recyclability, and Recoverability (RRR) Reporting required for Type Approval and the data required for compliance with the ELV Directive, Automotive OEMs have mandated data reporting requirements via the International Material Data System (IMDS) and GADSL. While other sectors use data exchange standards such as IPC-1752A and IPC-1754 to streamline supply chain communication, IMDS currently does not allow data entry via these standards, as it solely relies upon manual entry or a proprietary XML to take in data.

Electronic component suppliers in the automotive supply chain heavily rely on a standard convention for reporting into IMDS referred to as Recommendation 19. However, the convention is being eliminated and will require a significantly higher volume and more detailed data to be entered into IMDS. It remains to be seen if additional functionality will be added to aid suppliers in this endeavor, or if it will need to be addressed largely with concerted effort.

Social Responsibility

Cobalt, as well as tin, tantalum, tungsten and gold (3TGs) are predominately mined in conflict-affected or high-risk areas (CAHRAs) and may be sold by armed groups, funding further unrest. These mines may have little to no oversight and force workers into unsafe or unlawful conditions.

Automotive companies are directly tied to the practices of all supply chain actors, even down to the mining of raw minerals. In a landmark lawsuit, numerous companies, including tech and automotive leaders, were alleged to have used child labor for mining cobalt in the Democratic Republic of the Congo (DRC).

While acknowledging this case, it’s important to note that the automotive industry is one of the leaders in the responsible sourcing of minerals, with many companies moving beyond 3TGs cited in the Dodd-Frank Wall Street Reform & Consumer Protection Act and incorporating cobalt into sourcing programs. Automotive OEMs and industry groups such as Automotive Industry Action Group are leading this change, resulting in suppliers executing more supply chain due diligence activities in order to responsibly source their minerals. The automotive industry has looked beyond company-level reporting more than any other sector.

Extensive supply chain engagement is required to gather survey submissions such as the Conflict Minerals Reporting Template (CMRT) from upstream actors. The larger a supply chain, the greater the data collection burden.

Implementation & Impacts of the USMCA

In 2020, North American trade will undergo a dramatic change as the United States-Mexico-Canada Agreement (USMCA) replaces the North American Free Trade Agreement (NAFTA). The USMCA heavily impacts the automotive sector, and companies in this space will see changes to their data collection and reporting processes, as they will be required to pay more attention to the country of origin for material and labor practices. This is due to new sourcing rules that require more parts to be manufactured in North America, and new labor rules requiring parts to be made by workers earning at least $16 USD per hour.

How Assent Can Help

The Assent Compliance Platform simplifies the data management required to comply with global regulations through industry-leading automation and dedicated customer service. Companies gain supply chain transparency and traceability, increasing awareness of the substances and practices within their supply chain and enabling swift responses to risk. To learn more, contact our experts.